No Data, No Drama: How Behavioral Science Can Help the Banking Industry

By Flavien Hue

When Data Plays Hard to Get…

Since “Machine Learning” and “Big data” have become hot topics, data appears, in the eyes of many, as a requisite for businesses to improve their customers’ online experience and reach sales targets. Data is indeed one of the most valuable resources of our time. Although researchers, engineers and marketers always used some kind of data in their work, new technologies, such as Next Best Offer/Action/Product systems, leverage data, at scale, in ways never done before.

Next generation personalization is now at our reach. Algorithms can enable brands to offer customers what they need, when they need it, and maybe even before they realize it. For instance, HSBC has used customer data to predict how they might redeem their credit card points. In turn, the algorithm’s output was used to send customers personalized reward offers (e.g. cash or travel points) based on that prediction. Yet, there are still a number of hurdles preventing businesses and customers to really seize the power of data. And that is assuming data is easily accessible.

Despite the data gold mine at their disposal, the banking industry must face the challenges to merge, clean and analyze that data before starting to reap the benefits. This requires sizable investments in terms of infrastructure and talent. In an environment increasingly worried about data breaches and individual privacy concerns, data processing and usage are also heavily constrained.

Does this mean that banks cannot do anything to better serve their clients online? Of course not. While the eyes of the banking industry have been focused on data and its benefits, the power of applied behavioral science has been greatly overlooked. Seizing it opens the way to create remarkable customer experiences without most of the hurdles affecting massive data.

Let’s see how behavioral science can help achieve a better customer experience with limited data.

… Insights from Behavioral Science Can Save Your User Experience

Rigorously assembling evidence to derive general laws of human behavior and mental processes has been the foundation of the behavioral sciences since the 19th century. The behavioral sciences include well known disciplines as sociology and psychology, as well as hot-topic sciences like neuroscience and behavioral economics. Those disciplines have already a wealth of insights accumulated on what drives people’s (and therefore customers’) decisions. The insights’ value resides in their actionability, contrasting with machine learning algorithm outputs, which can’t always be easily understood or applied beyond the specific problem they solved.

Before plunging the organization into a data revolution to improve customer experience, behavioral insights should be applied as they are a more cost-effective way of reaching that goal. While this assumption may go against mainstream industry thinking, it’s certainly worth exploring.

These three simple steps will help you improve customer experience using behavioral science:

1. Define your goal (you don’t need much data)

Business objectives drive R&D in the industry, and that holds in banking too. Whether it’s encouraging people to save more, having customers engage more with your site to sustain the online relationship, or motivating them to try on a recently integrated payment solution, these objectives can be turned into actual research questions. The question itself, or the specific business goal you aim for, will delimit the research area to set up a behavioral intervention. Having data from your customers, like web navigation, drop-off points or even customer profiles will help of course, but it is not required to move on to step 2.

2. Delve into the body of knowledge

Before starting to plan on how to address business objectives, take the time to catch up on the latest related behavioral insights from academia or private research reports. This will put you on the right path to design a customer centric experience.

In retail banking for example, there is a tremendous amount of evidence from behavioral economics regarding how people make savings decisions, handle debt, how emotions drive buying decisions, etc.

If you are not sure where to start, you can first have a look around this very site.

3. Test, using a control group

Testing is key to any worthy behavioral intervention for at least two reasons. First, even if much research has already been conducted on the topic, you will certainly need to validate your intervention. Indeed, the solution you implement to improve your customers’ experience might have to be adapted to your field or customer segment.

Testing will allow you to measure the impact of the intervention before applying it for all customers. This will save you the cost of implementing a bad intervention in case it did not work as planned.

These three simple steps can help you leverage your customer experience without any detailed customer data, just by adapting existing knowledge on human behavior with the appropriate methodology.

An example? Bear with me.

Example From a Field Experiment

I will illustrate my point here by reporting results of a project handled by our behavioral science team at exagens. This project aimed at encouraging customers from a major Canadian financial institution to complete the final registration phase for an investment program online and before the deadline. As investors qualify for a tax credit on the amount invested, and the number of applicants is limited, helping users not to miss the deadline is a sizable improvement on their experience with the bank.

Extracting and managing relevant customer data, such as account balances or visits to the branch was too expensive to target users in that project. On the other hand, a lot of research has already been conducted to understand why people delay tasks and how to encourage their on-time completion.

We found two promising approaches for the project’s objective:

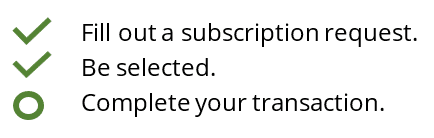

- Using a checklist to remember customers of the remaining registration step, as well as the initial steps they completed when applying for the program (Figure 1).

- Using a completion bar, to communicate through a visual the idea that the registration process was close to be completed (Figure 2).

Figure 1: Checklist nudge.

Figure 2: Completion bar nudge.

The two nudges were designed to appeal to our insensitivity to sunk costs and the resulting “completion bias”. They are intended to remind customers of the time they have already spent to get into the program, as well as indicating that there is not much left to do to complete the registration. Having unfinished business creates discomfort which acts in turns as a motivator.

In this field experiment, customers (N= 33,036) were randomly assigned to three groups, testing the effect of displaying a completion bar or a checklist on the intention to complete the process online immediately.

The three groups all saw the same message on the online banking platform. Its text informed customers about the deadline for them to complete their registration and invited them to finish on the spot. They were able to interact with the message to accept or refuse the proposition. The only difference from the control group was the presence of the checklist or the completion bar.

Findings

Results are striking. The checklist was successful in motivating people to complete the registration with a rate of 8.8%, compared to 6.9% for the control group. But the completion bar won the nudging contest by far with a rate of 13.2%, nearly twice as much as the control. As expected, the difference between both nudges and the control group is statistically significant and sizable.

But we couldn’t have guessed the gap between the completion bar and the checklist effectiveness prior to testing. From downloads progression to the levels completed in an online course, progress bars are well known and often associated to a reward (e.g. the pride from completing the course). On the other hand, the to-do list might put more emphasis on the tasks left to complete than the completion itself. If the task is not appealing to the person, it would be an explanation for the difference we observed.

Implications of this example for the banking industry are twofold. Exploiting customer data would have certainly allowed a more precise identification and targeting of the users more prone to complete the registration online (e.g. customers with funds available or customers who did not already register at the branch). But such technologies are not the only way of improving customer experience. Applying behavioral sciences knowledge and methodologies appears to be (for now) a more cost-effective alternative.

The two approaches, however, will not be opposed for long. As the technology develops both data science and behavioral research will become complementary, with the scalability of the former enriching insights from the latter.

Flavien Hue

Flavien Hue is Behavioral Scientist at exagens, a Montreal based fintech and behavioral banking pioneer. He received a MSc in Economics and Psychology from Paris Descartes University. Since then, he has been producing applied research on human behavioral biases in context of economic decision making to help bank customers in their financial journey. Combining behavioral and computer sciences enabled him to conduct large-scale projects for a greater impact on banks and their customers.